|

View: 3572|Reply: 17

|

What's your magic number for retirement?

[Copy link]

|

|

|

How much will retirement cost? If that question stops you in your tracks, you're not alone. More than half of workers have yet to compute how much money they'll need when they quit working. Among them, 77% can only "guess" how much will be enough, according to the Employee Benefits Research Institute.

That's a shame because studies indicate that people who have set retirement goals and saved for their retirements say life in retirement is actually better than they had expected. You don't need an advanced degree in finances to come up with how much you'll need in retirement. Just follow these five steps to arrive at that magical number: What's your spending style? Your first consideration should be taking a look at your expenses. If you've got a budget, you're a step ahead of the game because at this point you really need to know what you spend on a daily basis. If you don't have a current spending plan, it's time to start tallying numbers, from groceries to entertainment, mortgage or rent, utilities and so forth.

There are a slew of ways to get a handle on these costs. Keep track of bills and receipts for a month or two, or use financial software, such as Money or Quicken, to help. But as you look at the numbers, start thinking about if you'll get by with more or less in the future.

If you're not sure, take a cue from the pros. Financial advisers generally recommend you amass a nest egg that's big enough to get by in retirement on at least 70% to 80% of your working income. Other experts say it's much safer, and realistic, to plan on spending more, even up to 100% of your pre-retirement income. How old will you be when you retire? How low, or high, you set this number depends on a slew of personal factors. First and foremost is your age of retirement. If you plan on swapping that briefcase for a tennis racket at 60, you may be in for a case of sticker shock. It's not just that you'll likely have two or three decades of retirement, but financial resources may be greatly diminished if you cut out early.

Notably, workers now have to wait longer before they're eligible to receive full Social Security benefits. Those born in 1960 or after will now have to reach age 67 before they're able to receive full Social Security benefits. If they jump the gun, say at 62, they'll get less for the rest of their lives.

Most other retirement funds, such as 401(k) plans, IRAs or Roth IRAs make you wait before rushing into retirement. That's because you'll generally be subject to a 10% penalty on earnings if you tap into them before age 59 |

|

|

|

|

|

|

|

|

|

|

|

I guess range 40-45 adalah impian masing2 utk retire. Long way to go tapi perasaan mcm sedang enjoy retirement tu dah ada sikit2......since passive income dah ada eventhough not yet achieve my goal.

Utk yg mrk yg baru grad, atau yg baru berusia 20-an atau yg baru bekerja, below is my advice.

Utk berjinak2 dgn investment mulakan dgn jumlah kecil dulu. sebab yg penting ialah will power utk sustain & berterusan. the most important is do not saving/invest separuh jalan.......hangat2 taik ayam then start korek semua saving utk enjoyment & berseronok.

SELALU INGAT BAHAWA SAVING/INVESTMENT IS TO CREATE YOUR PASSIVE INCOME WHEN YOUR AGE REACH 45.

HOW DO YOU FEEL IF YOU HAVE A STEADY PASSIVE INCOME AT RM3000 PER MONTH EVEN BEFORE YOU REACH 40???

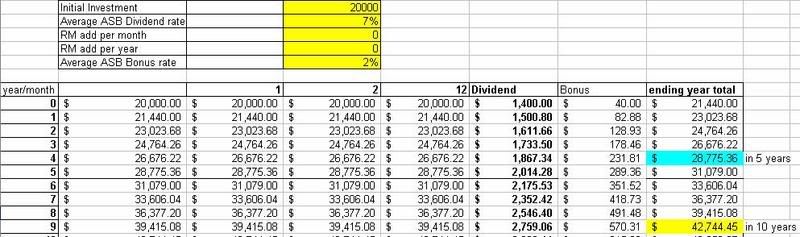

utk mrk yg baru berjinak dgn investment yg paling penting ialah stay motivated......utk golongan yg belum pernah buat investment, dan baru nak belajar.....my proposal to keep motivated ialah utk permulaan buat loan ASB for 20k dgn RHB Bank (the best rate as of February 2008) , monthly payment rm218 for 10 yrs dpt total SAVING of rm43,000 (anggaran) dlm 10 setahun.....

.......actually pd tahun ke 5 kita sudah berasa begitu motivated bila nampak duit itu beranak. by that time when you feel motivated, dgn sendirinya tanpa dipaksa2 kita akan buat saving 40% of our salary or more whitout complain, since the higher we save the faster we will achieve financial freedom. Financial Freedom ni keadaan di mana kita boleh pilih utk continue makan gaji or opt to resign......but what for nak resign ye tak....sure time tu kita akan bekerja tanpa rasa pressure & rasa minda lapang sebab pada masa tu dibelakang kita sudah ada back up of RM500,000 in term of invesment vehicle yg boleh generate 40,000 per year, bersamaan dgn ~RM3300 sebulan.

ASB adalah investment tool yg paling mudah utk memulakan pembelajaran investment. Then bila dah ready & minat semakin bercambah, start to explore into buying Apartment or Flat for rental/future value, Unit Trust, Option Trading, Overdraft technique and other investment tool. And to protect our wealth.....kita perlukan insurance. Kat sini ada ramai insurance agent who can give good advice, pls compare from product to product to suit our needs.

manakala yg dah berumur (50-an) tak perlulah invest kat tempat2 yg high risk..........sebab kalau market meredum warga tua ini takkan sempat nak recover balik. badan pun dah tak larat, penyakit pun dah byk mcmn nak kerja kuat mcm masa muda. lesap segala hard earn money. tak kan umur 55 nak start kerja teruk balik utk mengumpul modal. sementelah zaman kini (especially lelaki) hayat tak berapa panjang disebabkan life style & pemakanan. contohnya aruah hani mohsin & loloq...........

so start saving/invest, go for travel and enjoy life with family. kesibukan & tekanan bekerja utk mengkayakan majikan kadang2 buat kita terlupa nak visit parents sekerap mungkin sementara mrk masih hidup, berjumpa sahabat handai & memenuhi hobi sendiri.

so what is your magic number for retirement? |

|

|

|

|

|

|

|

|

|

|

|

What's your magic number for retirement?

|

|

|

|

|

|

|

|

|

|

|

Reply #2 shahgti's post

suka cara u shah..cara u give motivation.

selain penat mencari duit, jgn lupa enjoy travel while we can and welfare orang tua kita. |

|

|

|

|

|

|

|

|

|

|

|

|

For me, klu ada rezeki lebih skt better diversified kita punya investment..Utk yg baru2 of course masuk ASB + Tabung Haji, than cuba simpan sikit2 utk cukupkan RM1000 than invest dlm Unit Trust...So, cuba diversified RM200 sebulan, RM50 masuk ASB, RM50 masuk Tabung Haji & RM100 kat Unit Trust.. |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by kitt_fisto at 8-2-2008 09:39 PM

For me, klu ada rezeki lebih skt better diversified kita punya investment..Utk yg baru2 of course masuk ASB + Tabung Haji, than cuba simpan sikit2 utk cukupkan RM1000 than invest dlm Unit Trust.. ...

unit trust ni apa bende sebenarnya? ramai org dok sebot2.. aku baca tak paham pape pon :eek: :kant: |

|

|

|

|

|

|

|

|

|

|

|

|

emm kalau keje gomen ada pencen, rasanya tak payah la terlalu banyak sgt kot nak kene save.. tak larat aku :eek: |

|

|

|

|

|

|

|

|

|

|

|

kalo keja gomen tak ada apa yg nak ditakotkan...

pencen ada (walapon pun tak byk tapi konsisten sampai mati beb..)...

duit ganjaran pun adaaaaaaa...

walapon ada pencen adalah lebey elok kalo kita jugak ada saving yg bley generate

passive income secara konsisten walapon div ciput drp dok target div besaq yg

tak konsisten dividennya...

yg dok mention retirement plan ni lebey pd keja private.. |

|

|

|

|

|

|

|

|

|

|

|

best nye dpt keje gomen..ada pencen dan pelbagai kemudahan sume

u all ni dah masuk gred brapa? |

|

|

|

|

|

|

|

|

|

|

|

|

selain disiplin, gred pun penting kak..perlu seiring kenaikan pangkat dgn kenaikan iinflasi setiap thn |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by kitt_fisto at 8-2-2008 09:39 PM

For me, klu ada rezeki lebih skt better diversified kita punya investment..Utk yg baru2 of course masuk ASB + Tabung Haji, than cuba simpan sikit2 utk cukupkan RM1000 than invest dlm Unit Trust.. ...

kalau you ada 200k dlm tabung haji itu seratus kali lebih baik dari mrk yg cuma ada belen 10 ringgit dlm akaun saving biasa.  |

|

|

|

|

|

|

|

|

|

|

|

Reply #1 apekqws's post

aku x paham mksud ko ttg 'retirement'

retire dr apa? dr bekerja? dr cari duit? dr hidup? atau retire dr segala2nya ? itu dah mcm as good as dead meat... |

|

|

|

|

|

|

|

|

|

|

|

Nowadays, saving is a crucial task to do. Most retirees need to do so for their future. Many of us aim to reduce debt and save for retirement. But, today, it seems that it's a hard thing to achieve. Here is the source: Retirement Savings.

|

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|