|

View: 262638|Reply: 1141

|

UNIT TRUST PUBLIC MUTUAL; MACAMANA NAK UNTUNG CEPAT DAN BANYAK?

[Copy link]

[Copy link]

|

|

|

Aku buka topic ni untuk semua consultants unit trust, Untuk investors yang dah invest boleh juga sebagai pedoman dimana kalau u all pandai, u all boleh bagi instruction pada U all punya consultant masing masing..

REMINDER UNTUK CONSULTANT, YR JOB BUKAN SETAKAT JADI SALESMAN, KALAU U ALL NAK BERJAYA DALAM BIDANG INI, KENA MANAGE. POSITION U ALL UT CONSULTANT, BUKAN UT SALESMAN..

Untuk pelabur, anda kena bijak memilih consultant yang betul betul competence mempunyai product knowledge yang strong dan mampu menangani dengan bijak samada masa eko naik atau turun.

Tajuk Public Mutual aku gunakan because diff company with diff policy. Mungkin mekanisme sama, tapi dari segi execution, charges may be berbedza..

Kenapa aku pilih tajuk ini untuk share dengan U all yang masih tak tahu? Yang dah terer, jangan malu malu untuk share. Sebenarnya banyak cara U all boleh buat, tp saya ajar yg biasa dan basic dulu..

Reasonnya ialah, ianya boleh menbantu anda semua manage yr client's money dengan betul dan boleh bagi untung dengan cepat dan tinggi.

Market tahun 2009 tak menentu..,some people terai to skip 2009 dan kalau boleh terus nak ke 2010..

Untuk mereka yang buat sales dengan market KLCI 1500 barun baru ini, definately sekarang dalam negative melebihi 20%. (yesterday KLCI 882)

walopon masa presentation dgn investors, sebelom U all close deal, U all dah remind mereka, investment Ut secara BASIC, MEDIUM TO LONG TERM, 3 tahun and above.. tp some investors cepat lupa. Invest awal january,market tengah drop, mereka dah risau and ganggu U all nak concentrate dengan sales dan managing.

Untuk mencepatkan break even or profit u all kena buat sesuatu, bukan hanya menunggu market naik balik 1500 or 1400 kalau dah declare divident..

Aku akan bagi tips kat sini berperingkat since banyak data aku kena dapatkan banyak ACTUAL data, bukan assumption. |

|

|

|

|

|

|

|

|

|

|

|

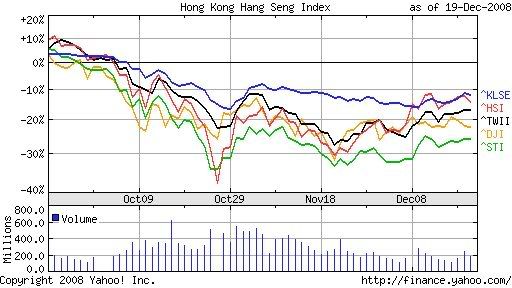

Untuk consultants..buat sementara u all study movement indeks ni..

STI singapore tak kena mengena,..hanya buat benchmark je..

nanti aku sambung..

?t=1230691999 ?t=1230691999 |

|

|

|

|

|

|

|

|

|

|

|

lupa nak tulis..rasanya U all mesti tahu kan..

HSI = HK

TWII = taiwan

DJ = Dow jones

STI = singapore |

|

|

|

|

|

|

|

|

|

|

|

Bila nak sambung nie tuan kirawang..   |

|

|

|

|

|

|

|

|

|

|

|

|

bagus la.. nak belajar jugak.. |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by hazri03 at 31-12-2008 02:08 PM

bagus la.. nak belajar jugak..

aku pong..! |

|

|

|

|

|

|

|

|

|

|

|

Ni adalah latest update from my friend and Pak Guru, Bill Wermine. Ada jugak Sis menuntut dgn dia pasal 'Swing Trading'. Ini adalah pendapat drpd salah satu market expert. Ada ramai expert diluar sana dan ada berbagai2 pendapat. Bill Wermine nye pendapat selalunya berpandukan pada candlestick chart.

Dear Traders,

Below is my outlook for the stock market in 2009. It will be published in Malaysian Business in their end Jan edition:

By the way, we plan a Traders Club meeting on Sat 7 Feb at 10 AM at CIMB auditorium and plan to have the head of Technical analysis of CIMB - (to be confirmed) - who will give his 2009 stock market outlook. Please let me know if you wish to attend Attached is the latest valuation of Man Essential, the recent launch. (30 Nov 2008 valuation)

How to Minimize your Costs and Risks while riding the 2009 stock market Bull

Below is a prophetic chart from Deutsche Bank research. It shows that stock markets bottom out a little more than half-way through recessions.

Based on this chart, I expect that 2009 will likely be a much better year for the markets than the year we have just endured. From this chart it appears that we are more than half way through the recession and probability is high that we will soon have a market recovery.

The Fuel to drive the Bull

We are on the verge of the Obama administration 搒timulating |

|

|

|

|

|

|

|

|

|

|

|

Amirul, hazri and mytrade..nanti saya sambung..

besok nak balik kg kat K trg..

tulis kat sini, kena fikir..

kena cari masa masa tenang sikit.. |

|

|

|

|

|

|

|

|

|

|

|

best ada thread nie....

thanks so much....aku harap sgt korang yang jadik ajen nie boleh konsult freedomly kat thread nie walaupun ada di antara forummers bukan client korang...my agent pun tak konsult nak suh buat apa.... time market camnie...nak switching ker nak remain ker...maybe sebab kita bukan pelabur jutawan....jadik tak efek sgt ler gamaknyer...komisen pun dapat sikit jadik tak berapa nak jaga......

aku harap sgt agent haku tuh jgn manis mulut jer nak tarik orang suh invest...tapi tak cadang nak suh buat apa untuk menguntungkan pelabur....cukup dah air liur berkoyan-koyan....pegangler amanah pelabur yang beri kepercayaan untuk agent buat yang terbaik walaupun dia melabur RM 1k cuma..... |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by frapamocha at 31-12-2008 05:18 PM

Ni adalah latest update from my friend and Pak Guru, Bill Wermine. Ada jugak Sis menuntut dgn dia pasal 'Swing Trading'. Ini adalah pendapat drpd salah satu market expert. Ada ramai expert diluar ...

tq sis frapa...

ramai yg nunggu 2009.....ada yg kata market kita akan pulih sikit2....ada yg kata akan makin teruk...apa jua persepsi harus berdsarkan fakta yg berasaskan data...

skrg nampak macam market berlegar dlm keadaan diskaun 40% dari peak...

emmm....pelabur yg bijak tentu suka dgn keadaan skrg..... |

|

|

|

|

|

|

|

|

|

|

|

klu 2007 boleh guna aja machine gun....

2008 berundur dan berkubu...

2009..hit n run.... |

|

|

|

|

|

|

|

|

|

|

|

|

bagus juga...bole aku belajar pasal UT ni..hehehhe |

|

|

|

|

|

|

|

|

|

|

|

Adakah pesanan ni relevan utk tajuk di atas? Sangatlah relevan ....... Pelaburan UT dlm dana ekuiti walaupun tidak secara direct, juga melabur dlm saham2 di Bursa Msia dan regional atau global mkt. Risiko tidak setinggi brbanding dgn mrk yg melabur direct dlm stock mkt. Dalam dunia pasaran saham/stock mkt, ada term "cut loss" or "exit strategy" tp dalam dunia unit trust ada term "switching". Stock mkt/ average-down = Unit trust/Dollar-cost-averaging.

Dear Business Partners & Friends,

2008 has been a very challenging year for everyone investing and trading in the stockmarkets worldwide. Failing mortgages, falling commodities and crude oil prices, recession in the USA and Europe is causing extreme volatility in the world stock markets.

Many giant US corporations and financial institutions have gone or is on the verge of going bust, a never seen before phenomena, causing serious bear market worldwide.

Many remisiers murmured that their clients, and even themselves, had accumulated huge losses during 2008, giving back gains they had accumulated in 2007. Many more clients have recently sold positions they had been holding in the hope that the market will rise, thus realising higher significant losses than they would have, had they cut their losses a couple of months ago. One common question that many are also asking, "Have the market hit the bottom?".

The accumulation of huge losses, the squaring off of positions only after a big continuous drop, and the search for opinions on whether a bottom has been reached are common issues faced by many retail clients.

Buy and hold strategies that fail to honour the concept of cutting losses contributes to most of the huge losses accumulated by retail clients. It displays the lack of discipline and illustrates an all too common issue of letting losses run, for fear that the market will rebound immediately after they sell. Yet, this continues to happen time and time again, and more losses are accumulated.

Starting from basic is to have a trading plan. The plan will provide us an edge that predictions don't provide, identifying the strategies on how to make winning trades that significantly exceed the losing trades, hence making net profits.

One of the strategy, a key component of a trading plan, is to define an exit strategy to be in place before a position is entered, as this will inevitably reduce the possibility of accumulating huge losses.

Trading plan must include exit strategies which must be followed through with discipline. Exits are more important than entries, yet the majority of clients spend most time seeking the ideal entry strategy, if they have one!Everyone can have identical entry levels, yet the outcome of trading always differs from big losses to big profits.

Exits determine the outcome of our trading and have more impact on how much profits or losses we make. The only purpose of timing of entry is to get started in the right direction as accurately as possible, and everything that happens after that has nothing to do with the entry as the outcome of our trade is now in the hands of our exit strategies.

Selling positions only after losses have become too big rather than as a consequence of a pre-determined exit strategy is a characteristic of many retail clients. The fact that many retail clients liquidate positions too late may be a signal that we are nearing a bottom. We have gotten to the point where there are fewer and fewer sellers left.

Nobody can tell whether we have a final bottom or not. To try to predict this is a futile exercise. A big sell-off on high volume is often indication that we may be seeing a bottom, but like anything else in the markets, this is not certaint. While we may predict that the KLCI index or a sector or a stock is going to move in a certain direction, we must always keep in mind, understand and accept that our prediction may be wrong and be ready to pull the plug as soon as a wrong call is made.

So, go back to basics, advise your clients to prepare a trading plan with their own exit strategy which is both clear and close to the entry price. You all have heard this saying before, "If you fail to plan, you are planning to fail".

Hopefully, you will be among those who will take this effort, for without it, you may continue with the vast majority who fail in their trading effort.

Happy New Year to everyone and may 2009 be a better year ahead.

Rgds,

Me. |

|

|

|

|

|

|

|

|

|

|

|

Balas #16 pojikun85\ catat

eh, x silap aku ko pon under kirawang kan

kita serupa...  |

|

|

|

|

|

|

|

|

|

|

|

Reply #18 pojikun85's post

pojikun.. skywalker ni cewek laa.. (perempuan)..

awat laa ko panggil bro..  |

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|