|

|

UNIT TRUST PUBLIC MUTUAL; MACAMANA NAK UNTUNG CEPAT DAN BANYAK?

[Copy link]

[Copy link]

|

|

|

mahsyuk betul kirawang dgn hanseng dan PCIF nie..

sampai fundholders cam mytrade pun rasa tertekan baca ayat switching

[ Last edited by amirul_nazri at 4-5-2009 23:36 ] |

|

|

|

|

|

|

|

|

|

|

|

Pasaran lepasi 1,000 mata

PELABUR melihat papan penanda aras IKKL yang menunjukkan kenaikan sehingga ke paras melebihi 1,000 mata, semalam.

--------------------------------------------------------------------------------

KUALA LUMPUR 4 Mei - Pasaran saham tempatan yang melepasi paras 1,000 mata buat kali pertama hari ini sejak tujuh bulan lalu, mampu melonjak ke paras 1,118 mata untuk tempoh terdekat.

Indeks Komposit Kuala Lumpur (IKKL) hari ini ditutup pada paras 1,009.36, naik 18.62 mata atau 1.84 peratus.

Pengarah Bersekutu OSK Research Sdn. Bhd., Chris Ng berkata: "Dari tinjauan pasaran yang kami lakukan, mata IKKL diunjur berlegar antara 960 hingga 1,040 mata pada bulan Mei ini."

Difahamkan peningkatan IKKL sehingga paras 1,118 boleh berlaku selepas pasaran melalui proses pembetulan yang bakal menyaksikan harga jatuh sebelum meningkat semula.

Ng ketika dihubungi Utusan Malaysia di sini hari ini berkata, beliau melihat peningkatan semasa itu sebagai satu tanda positif selepas masyarakat pelabur sebelum ini agak kritikal dengan perkembangan ekonomi Malaysia.

Katanya, faktor sentimen positif turut memainkan peranan kepada peningkatan IKKL dan menjangkakan indeks akan berada melebihi 1,000 mata pada bulan ini.

Ujarnya, saham-saham mewah akan terus menjadi tumpuan pelabur walaupun berlaku penjualan saham bermodal kecil pada pertengahan bulan ini.

Pengarah Eksekutif Jupiter Securities Sdn. Bhd., Nazzary Rosli turut mengakui prestasi IKKL juga didorong oleh khabar positif pasaran saham Amerika Syarikat (AS) yang menunjukkan tanda-tanda pemulihan.

''Pasaran saham negara itu kini mulai kembali stabil dan setakat ini, tiada sebarang berita negatif dilihat muncul dalam tempoh masa terdekat. Ini sekali gus memulihkan semula sentimen pelabur di AS dan juga Asia.

''Bagi pelabur tempatan pula, keyakinan mereka mula pulih apabila berlaku peralihan kuasa dalam tampuk pentadbiran negara. Melalui pengumuman dan pengenalan dasar baru, Perdana Menteri yang baru telah menjanjikan perubahan kepada ekonomi negara,'' katanya.

Tambah Nazzary, sejak Datuk Seri Najib Tun Razak memegang terajui, pasaran saham tempatan dilihat juga mengalami kenaikan ekoran perubahan yang dilakukan beliau termasuk dasar liberalisasi yang diumumkan baru-baru ini.

Sementara itu, Penganalisis Inter-Pacific Securities Sdn. Bhd., Koay Yi Chuan berkata, walaupun IKKL melepasi paras 1,000 mata, paras itu tidak akan kekal, sebaliknya akan berlaku pembetulan.

''Pembetulan pasaran itu bakal menyaksikan berlakunya sedikit kejatuhan sebelum pasaran saham mula naik semula. Namun tidak dapat dipastikan bila ia akan berlaku.

''Selain itu, sebarang berita tentang selesema babi (virus H1N1) yang melanda dunia ketika ini, juga dilihat mempengaruhi sentimen pelabur kerana mereka akan lebih berhati-hati akibat bimbang pasaran akan terjejas,'' katanya.

Yi Chuan berkata, langkah kerajaan yang memperkenalkan liberalisasi dalam beberapa sektor telah menggalakkan pelabur asing datang melabur di pasaran tempatan yang secara langsung membantu meningkatkan sentimen pasaran. |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by mytrade at 5-5-2009 09:11

jeles tgk org lain tunggang untung ......geram siotttt!

Tak pe, setakat tu je Rezeki kita....

sabar and Hang seng macam Yoyo, kejap baik, besok lusa turun le..sw je balik.. |

|

|

|

|

|

|

|

|

|

|

|

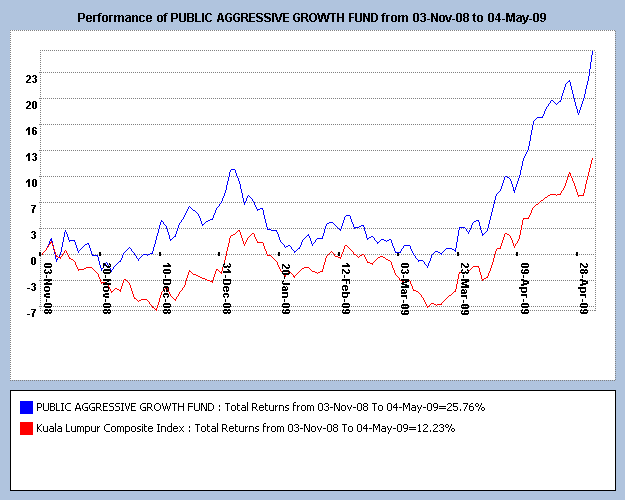

Sapa invest PCIF 6 bulan lepas...dah dapat 25.5 % dah...

?t=1241506777 ?t=1241506777

over perform against china, hs and taiwan market |

|

|

|

|

|

|

|

|

|

|

|

beli PCIF masa new launch hari tu...huhu huh..tak tau nk buat pe..tunggu ke? |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by anasue at 5-5-2009 16:22

beli PCIF masa new launch hari tu...huhu huh..tak tau nk buat pe..tunggu ke?

anasue, khatam thead ni 2-3 kali ni, dan for sure.. guarantee, anasue tahu apa nak buat.. |

|

|

|

|

|

|

|

|

|

|

|

|

hmmmmm kalau bleh beli...beli ler...kalau tak switch aja ekk...?? yang penting haku tak bleh nak jual...rega di bawah harga launch...nanti rugi haku.......... |

|

|

|

|

|

|

|

|

|

|

|

When investing in stocks control your greed and fear

We need to know who we are in order to do well in stock market investing

THE recent strong market rally caught many investors by surprise again.

Most investors, including some analysts, predicted earlier that it was just a bear market rally. They have been hoping the market will turn down again. Unfortunately, it has been moving up strong without looking back.

For investors who have not invested during the recent low in March 2009, they are getting very worried as they are not benefitting from the recent rally. They may even wonder whether they should jump in now in order not to miss the boat.

Another group of investors, who have managed to catch some stocks at cheap prices during the previous market low, are also facing the dilemma of whether to lock in their gains now or continue to hold on to their gains. Some even regretted selling their stocks too early last month.

We all know that it is very difficult, in fact impossible, to predict stock market movement. Most investment gurus will refuse to time the market.

Howard Kahn and Cary Cooper published a book titled “Stress in the Dealing Room” in 1993. According to their surveys done on 225 dealers, 73.8% of them suffered from fear of “misreading the market.” Most dealers have the same problem of acquiring and handling information.

We believe that in order to do well in stock investing, we need to know ourselves, especially in controlling our emotion on greed and fear.

Due to information overloading, our emotion is highly influenced by the news that we read. Each time we feel that the market is getting bullish and time to buy stock, the overall market will collapse the moment we enter.

On the other hand, the moment we fear that it will drop further and we have decided to cut losses, we will notice the market will recover after that. Most of the time, the prices of stocks that we sold were at the lowest of the recent fall.

In order to control our greed and fear, we need to ask ourselves whether the market has discounted the news that we have received.

For example, many analysts have been bullish lately, having the opinion that the worst may be over for the market based on the recent economic indicators which showed that the overall economy may have stopped contracting or is on its way to recovery.

Nevertheless, the recent strong market rally would have discounted this bullish news. In fact, we need to ask ourselves whether the current stock prices can be supported by the fundamentals for certain listed companies.

In our experience, in most cases, the moment we feel like buying stocks is the best time to sell them while the moment that we feel like selling them is in fact the best time to buy. We can apply this contrarian theory quite successfully in most periods.

Sometimes, if we are taking in too much contradicting information and, as a result, get confused over the market direction, we feel that the best strategy is to stay away from the market until we have a better and clearer picture of the overall market or the economic situation.

We should not be influenced by other opinions.

There are times that we need to follow our heart. Sometimes, our hearts try to warn us from taking hasty investment decisions. However, we refuse to follow our intuition but instead, choosing to get influenced by others or the information that we read and ending up making mistakes.

In conclusion, we need to maintain our concentration.

We should not be led by the market sentiments regardless whether it is on the way up or crashing down fast. We need to go back to the fundamental of economic situation and the companies’ performance and future prospects.

One way to minimise the feeling of regret is to stagger our purchase and selling. We will only know the peak when the market starts turning downwards and vice versa. Therefore, by staggering, we will have an averaging effect rather than taking a one-time hit, especially if it is at the wrong timing.

Ooi Kok Hwa is an investment adviser and managing partner of MRR Consulting |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by iena_kindaichi at 5-5-2009 22:34

hmmmmm kalau bleh beli...beli ler...kalau tak switch aja ekk...?? yang penting haku tak bleh nak jual...rega di bawah harga launch...nanti rugi haku..........

kak eina ada buat averaging cost tak..? few my fundholder yg buat value averaging dah ada profit..they bought during launching time. |

|

|

|

|

|

|

|

|

|

|

|

|

mmm.. dah lama gak tau pasal switching ni... kawan2 pun ramai jual UT ni.. kekadang depa ada cakap co tak galakkan jual or switch dlm masa terdekat..1-2 tahun... pasal kalau semua orang bantai switch or sell... dana dlm fund kurang stabil... kejap kurang kejap naik.. tu cakap depa la |

|

|

|

|

|

|

|

|

|

|

|

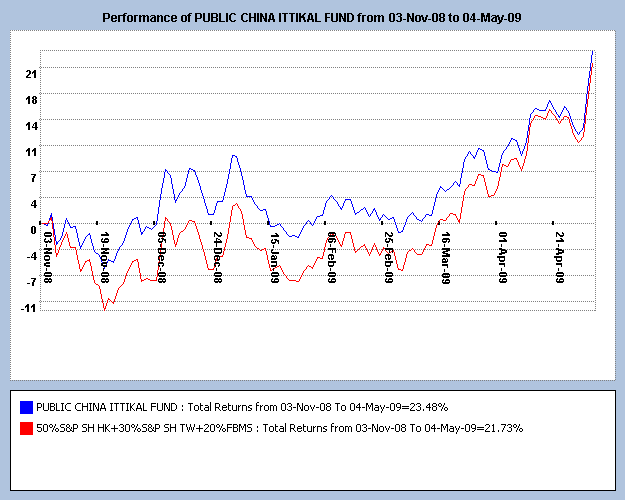

?t=1241579490 ?t=1241579490

sory., yang kat atas tu, bulkan PCIF..ini yang betul.. |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by Z77 at 6-5-2009 10:27

mmm.. dah lama gak tau pasal switching ni... kawan2 pun ramai jual UT ni.. kekadang depa ada cakap co tak galakkan jual or switch dlm masa terdekat..1-2 tahun... pasal kalau semua orang bantai sw ...

mmg betul....

tapi bagi some pressure to fund manager, biar mereka solve..

gaji mereka pon puluh puluh ribu sebulan, so mereka kena kerja kuat sikit. |

|

|

|

|

|

|

|

|

|

|

|

Nampak macam ada correction..tapi masih menaik...jam 2-30

|

|

|

|

|

|

|

|

|

|

|

|

|

mcm mana dgn piadf skrg bro?dh naik ker..saya dh msk 2thn..beli masa launch..dulu time jatuh mls nk cek..sakit ati je..skrg dh naik tu nk tnya.. |

|

|

|

|

|

|

|

|

|

|

|

KLCI ends up, reversing early decline

KUALA LUMPUR: An overnight fall on Wall Street set the tone for a weak start for regional markets, including Malaysia, on May 8. However, investors regained their confidence in equities, and most regional markets bounced back from their early lows.

Wall Street pulled back from its long running rally on profit-taking activities and ahead of the long-anticipated stress test on the health of the US banking sector. The two-month rally on Wall Street has pushed the S& 500 index by some 36%. While there is optimism and increasing signs of an economic recovery ahead, some intermittent profit-taking activities are also to be expected.

The stress test results, released after the US markets closed, showed that the banking sector was secure, but credit losses over the next two years could total US$600 billion, and 10 banks were ordered to raise US$75 billion in private capital over the next seven months.

According to the report, Bank of America will need to raise US$34 billion, Citigroup US$5 billion and Morgan Stanley US$1.8 billion.

Meanwhile, US economic data continue to better than expected, suggesting a moderation in the economy抯 decline. New unemployment claims fell to 601,000 last week from a revised 635,000 the prior week, and against expectations of 635,000. This was a three-month low. All eyes will be on the April jobs reports, due on May , which will provide a better picture of the labour market.

Following most of its regional counterparts, the local stock market opened lower, but later regained its footing to end in positive territory.

The KLCI fell as much as 9.5 points in the morning, but returned to the black just before the lunch break, and ended 3.3 points higher at 1,026.8.

Market breadth was positive with advancing stocks beating declining ones by a 3-to-1 margin. Trading volume remained high with 3.25 billion shares changing hands, although slightly lower than Thursday抯 year high of 3.3 billion shares.

Actively traded stocks include Compugates, Iris, PDZ, SAAG, Ramunia, KNM and Patimas. Major gainers include BAT, Magna Prima, UEM Land and Bursa Malaysia. Losers include KL Kepong, DiGi, MISC-foreign and BCHB. |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by kirawang at 4-5-2009 14:56

anda boleh switch . kena sw full. dah ada account PIMMF, nanti apply telemutual pin no, lps tu boleh switch sendiri.

oo..jdnye capital kita dlm equity dah takde?

apa efek kpd investment kita?

utk switching ni caj rm25 kan?

kirawang rasa klu profit dlm rm180 dgn capital 2k..berbaloi ke utk buat switching?

dan klu saya di pihak agent plak..

apa efek komisyen saya jika switching dilakukan?

adakah personal sale saya akan berkurangan?

forum ni dpt membuka mata dan minda saya utk berada di kedua2 pihak, investor n consultant..

terima kasih kerana berkongsi ;) |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by linsyah at 12-5-2009 00:41

oo..jdnye capital kita dlm equity dah takde?

apa efek kpd investment kita?

utk switching ni caj rm25 kan?

kirawang rasa klu profit dlm rm180 dgn capital 2k..berbaloi ke utk buat switching? ...

sorry lambat reply..tak terkejar dengan kenaikan market sekarang.

Istilah berbaloi itu tidak, awak yang tentukan..

dan berbaloi tak, awak rasa jika tidak berbuat apa2 anda akan mengalami kerugian jika market drop..

dan jika anda sendiri agent, sw tkdak ada kena mengena dengan komisyen.

Switching dilakukan oleh agent yang concern dengan investment pelabur mereka dan amanah yang telah diberikan..

Tidak ada apa2 ganjaran diberikan ... |

|

|

|

|

|

|

|

|

|

|

|

Originally posted by mohaz69 at 9-5-2009 13:24

mcm mana dgn piadf skrg bro?dh naik ker..saya dh msk 2thn..beli masa launch..dulu time jatuh mls nk cek..sakit ati je..skrg dh naik tu nk tnya..

PIADF rasanya meningkat,..semua fiunds asia, china meningkat sekarang inline dengan kenaikan pasaran mereka..tp saya tak begitu concern sangat fund ni., psl tak de investor invest dlm fund ni.. |

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|