|

|

UNIT TRUST PUBLIC MUTUAL; MACAMANA NAK UNTUNG CEPAT DAN BANYAK?

[Copy link]

[Copy link]

|

|

|

820# chayuk

aku kalo jual takkan buat sendrik..

tetap nk ejen jualkan

nk tengok gelagat dier....

pehtu aku akan decide..tak professional kalu....out u go!

duit aku! |

|

|

|

|

|

|

|

|

|

|

|

heheh...cuba korang check product ETF (exchange traded fund) plaks..nie bakal jadi great competitor kepd UT nanti  |

|

|

|

|

|

|

|

|

|

|

|

Salam..

Capital PIEF yang dibuka pada hujung tahun lepas adalah 2k. kini profit +-30%. Namun profit tersebut tidak mencapai 1k utk dibuat switching.

Soalannya..

Apa pandangan ahli forum..

1) Patutkah di lock profit tersebut bersama separuhnya daripada capital ie 30% profit + 70% initial capital (bagi melayakkan membuat switching). Adakah ini etika sebenar dlm UT? atau...

2) Biarkan sehingga profit sendiri 1k baru boleh lock?

Terima kasih ;) |

|

|

|

|

|

|

|

|

|

|

|

|

lama aku tak mai sini.....KLCI ujung tahun ni mcm yoyo sikit ler.. |

|

|

|

|

|

|

|

|

|

|

|

|

hmmm kalau nak jual unit kena thru agent sendiri atau boleh mana-mana agent yer..... |

|

|

|

|

|

|

|

|

|

|

|

|

mendap ker apa nih..mn tuan kirawang punyer posting...aku nak bace nih |

|

|

|

|

|

|

|

|

|

|

|

Salam..

Capital PIEF yang dibuka pada hujung tahun lepas adalah 2k. kini profit +-30%. Namun profit tersebut tidak mencapai 1k utk dibuat switching.

Soalannya..

Apa pandangan ahli forum..

...

linsyah Post at 30-11-2009 23:59

takder limit utk switching. As long as minimum 1000 units...Secukup rasa u nak switch berapa amount..consult ur agent. |

|

|

|

|

|

|

|

|

|

|

|

hmmm kalau nak jual unit kena thru agent sendiri atau boleh mana-mana agent yer.....

iena_kindaichi Post at 1-12-2009 20:38

kena thru agent sendiri or diri sendiri..takleh trhu agent lain..sbb agent kena finger print check during submission to verify |

|

|

|

|

|

|

|

|

|

|

|

|

knp pcif x dpt dividend...x untung ke... |

|

|

|

|

|

|

|

|

|

|

|

knp pcif x dpt dividend...x untung ke...

monreyes Post at 2-12-2009 17:34

distribution policy is also based on market performance bro..not guaranteed. benda ni ramai agent yg tak betau.. |

|

|

|

|

|

|

|

|

|

|

|

|

tapi ramai yg jangka PM announce dividend utk yg ni kan...what a let down.. |

|

|

|

|

|

|

|

|

|

|

|

tapi ramai yg jangka PM announce dividend utk yg ni kan...what a let down..

monreyes Post at 2-12-2009 23:23

menjawab persoalan ko nie, aku ada copy and paste dpd http://www.min.com.my...pay attention to item 1 and item 4

Dispelling Unit Trust Myths

There are several misconceptions that a unit trust investor needs to be aware of. Read on to discover the true story behind seven common myths of unit trust investment.

1.

The best time to invest is just before the dividends or bonus distributions are declared.

Not true. If your unit trusts agent advises you to invest in unit trusts funds due to its upcoming bonus or dividends payments and that you will make profit quickly, think again. You need to know what is involved in unit trust bonuses and dividend distributions. Bonuses will increase the number of units of the fund. For example, your investment in a fund cost RM1 per unit and you invested RM1,000 for 1,000 units. The fund then gives a bonus of one unit for every unit you have (a one-for-one bonus). Subsequently, you have 2,000 units. But the additional units do not increase the value of your investment to RM2,000. It will remain at RM1,000 because the additional units actually reduce your unit value from RM1 to RM0.50 (RM1,000 divided by 2,000 units). Similarly if your fund declares a 5% or RM0.05 dividend, you unit value will be reduced from RM1 to RM0.95 after the dividend is distributed. The dividend will not increase your unit value to RM1.05. So, investing prior to dividend or bonus declarations is not a quick way to make profits. Always think long term when investing in unit trust.

2.

Always choose funds that give the highest return in the past.

Not true. Past performance is not an indicative of future performance. Investors should not look at past performance records to predict future prospects. Study the fund's investment strategy and asset allocation to support your investment decision. Generally, the asset allocation contributes significantly to the fund's overall returns.

3.

All unit trust funds are the same.

Not true. There is a variety of funds out there with different investment objectives. Each has its own investment characteristics and risk elements. Investors MUST read the fund's prospectus to learn about the funds and should consider choosing the funds that match their investment needs and risks profiles. You could end up investing in the wrong fund if you think that all unit trust funds are the same.

4.

Dividend is the only return.

Not true. Investors can measure the performance of their investments in unit trusts by various means. This often includes the calculation of capital gains (the difference between the buying and selling price) or the amount of distributions received from a fund. However, the most effective method in calculating performance is by including both. This performance measure is called total returns as it includes all sources of income i.e. dividends and capital gains (or losses).

5.

Unit trusts is a savings account and risk-free.

Not true. Investing in a unit trust is not the same as putting your money in a savings account. If you invested RM1,000, you must be prepared to accept that you may end up with less money than you put in. This is because your investment will be exposed to risks and you may incur losses due to the inherent risks. All forms of investments do carry some degree of risk and investors must be prepared to accept such risks.

6.

Trust one management company only.

Not true. Not all funds from the same management company give out the same performance or return because these funds may have different investment objectives and therefore will have different risk elements and exposure. Depending on market conditions, funds would perform differently, even if the same management company is managing it.

7.

Your agent's words are the whole truth.

Not true. Always verify what your agent tells you. If you are not clear or if you think that it is too good to be true, ask them as many questions as you want. The questions that you think are "stupid" may actually turn out to be spot-on queries for gathering more information. At the same time, do your homework and get as much information as possible to help you make an informed investment decision. Don't invest until you are satisfied with the information provided to you. Remember, you will ultimately be responsible for your investment decisions and not your agent.

Back to top |

|

|

|

|

|

|

|

|

|

|

|

distribution policy is also based on market performance bro..not guaranteed. benda ni ramai agent yg tak betau..

amirul_nazri Post at 2-12-2009 19:38

haaa btoll lah tuh,,,,sampai skang aku tak nampak lagi penyata distribution pcif.... |

|

|

|

|

|

|

|

|

|

|

|

br nie ada membe bgtau ada ejen ckp public dana islamic opportunities (PIOF) nie ala-ala mcm ASB btl ker?

die ckp msk fund nie tiap2 ujung thn dpt dividend yg dicreditkan dlm akaun btl ker?

harga skang 0.82 ?

ada sesapa bleh bg komen tentang fund nie... |

|

|

|

|

|

|

|

|

|

|

|

835# lostnfaun

ko jgn terpedaya

tk sama sebenarnya weyy |

|

|

|

|

|

|

|

|

|

|

|

br nie ada membe bgtau ada ejen ckp public dana islamic opportunities (PIOF) nie ala-ala mcm ASB btl ker?

die ckp msk fund nie tiap2 ujung thn dpt dividend yg dicreditkan dlm akaun btl ker?

harg ...

lostnfaun Post at 16-12-2009 00:33

Agent mana tue? ko ada no.phone dia tak? kalau dpt agent code lagi sodapp...boleh aku report kat public mutual sbb bagi fakta yg salah.. |

|

|

|

|

|

|

|

|

|

|

|

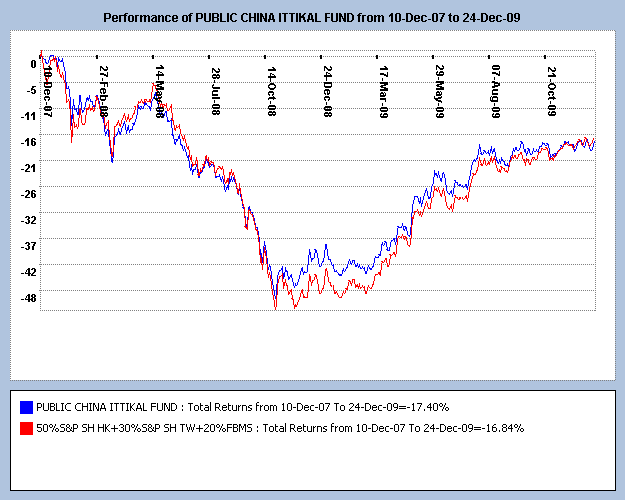

PCIF masih lagi loss sapa beli masa launched tanpa apa2 act like switching, etc..

|

|

|

|

|

|

|

|

|

|

|

|

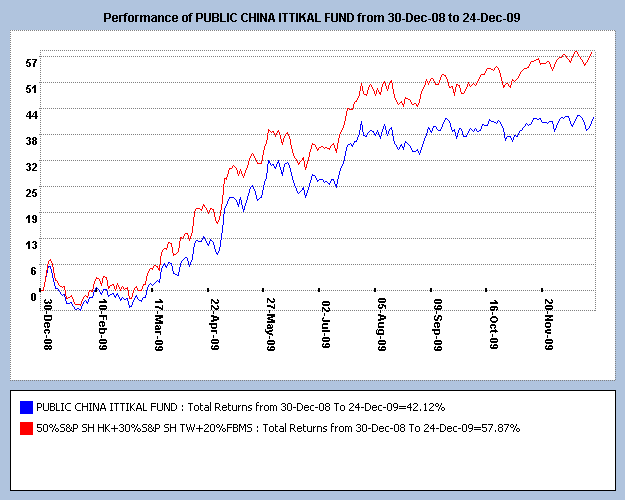

dalam masa setahun dr semalam, untung dah banyak..42%

|

|

|

|

|

|

|

|

|

|

|

|

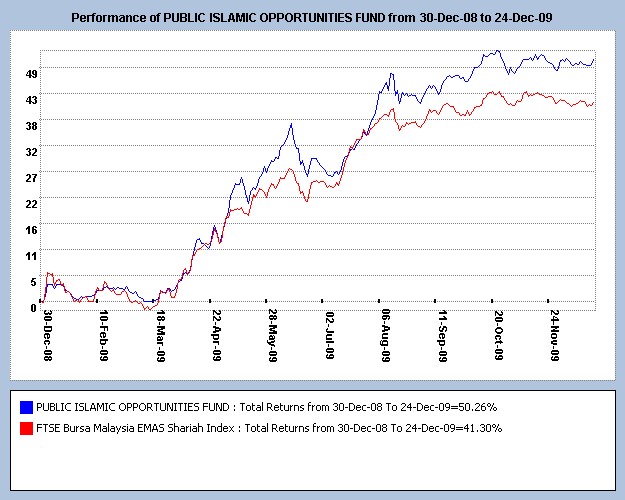

PIOF antara yg consistent..

untung 50%, setahun, up to yesterday..

|

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|