|

|

UNIT TRUST PUBLIC MUTUAL; MACAMANA NAK UNTUNG CEPAT DAN BANYAK?

[Copy link]

[Copy link]

|

|

|

kena thru agent sendiri or diri sendiri..takleh trhu agent lain..sbb agent kena finger print check during submission to verify

amirul_nazri Post at 2-12-2009 09:22

boleh ...org lain boleh uruskan....finger print just a matter mereka nak simpan rekod the person yang buat repurchase tu. |

|

|

|

|

|

|

|

|

|

|

|

|

ok...tq explaination...aku cam nak jual pcif.....tak untung..... |

|

|

|

|

|

|

|

|

|

|

|

ok...tq explaination...aku cam nak jual pcif.....tak untung.....

iena_kindaichi Post at 29-12-2009 21:31

pendapat aku sebagai pelabur yg tak berapa cerdik pasal ut nh

Ko jual hanya kalau ko memang nak pakai sangat duit tu atau kerugian cuma sikit.

invest UT duit yg memang ko tak plan nak guna dlm masa terdekat

Aku rasa kurang bijak klu nak jual semata2 sebab harga jatuh.

tunggu la dia naik semula...lgpun PCIF skang trend dia menaik

cuma 2-3 bulan nh dia memang terhegeh2....

tapi klu beli 25 sen then tak buat apa2,

rasanya berpeluh jugak la nak tunggu naik balik 25 sen tu...

aku dulu beli 25 sen then aku byk buat DCA masa harga murah.

Alhamdulillah skang dh ada untung....

klu dia naik balik 25 sen...jawabnya....PAKCIK KAYOOO... |

|

|

|

|

|

|

|

|

|

|

|

pendapat aku sebagai pelabur yg tak berapa cerdik pasal ut nh

Ko jual hanya kalau ko memang nak pakai sangat duit tu atau kerugian cuma sikit.

invest UT duit yg memang ko tak plan nak guna dlm m ...

chayuk Post at 30-12-2009 08:43

you're so smart ..dude. |

|

|

|

|

|

|

|

|

|

|

|

pendapat aku sebagai pelabur yg tak berapa cerdik pasal ut nh

Ko jual hanya kalau ko memang nak pakai sangat duit tu atau kerugian cuma sikit.

invest UT duit yg memang ko tak plan nak guna dlm m ...

chayuk Post at 30-12-2009 08:43

hmmm......aku nak jual sebab nak pakai duit......pcif jerah nak jadik mangsa pun....sebab asik jatuh jer memanjang......aku mmg tak buat dca dan beli masa launch.... |

|

|

|

|

|

|

|

|

|

|

|

hmmm......aku nak jual sebab nak pakai duit......pcif jerah nak jadik mangsa pun....sebab asik jatuh jer memanjang......aku mmg tak buat dca dan beli masa launch....

iena_kindaichi Post at 31-12-2009 22:23

Tak buat DCA and sw mmg negative lagi lah..

btw, market Hang seng dah start naik, harga pcif dah naik 0.2080..

antara tertinggi ni...slps kejatuhan. |

|

|

|

|

|

|

|

|

|

|

|

|

haah...nak nunggu naik samppai 0.25...ntah biler lah... |

|

|

|

|

|

|

|

|

|

|

|

haah...nak nunggu naik samppai 0.25...ntah biler lah...

iena_kindaichi Post at 5-1-2010 19:37

this year boleh reach kot....for sure price semalam naik lagi (publish after 11:30pm) hari ni... |

|

|

|

|

|

|

|

|

|

|

|

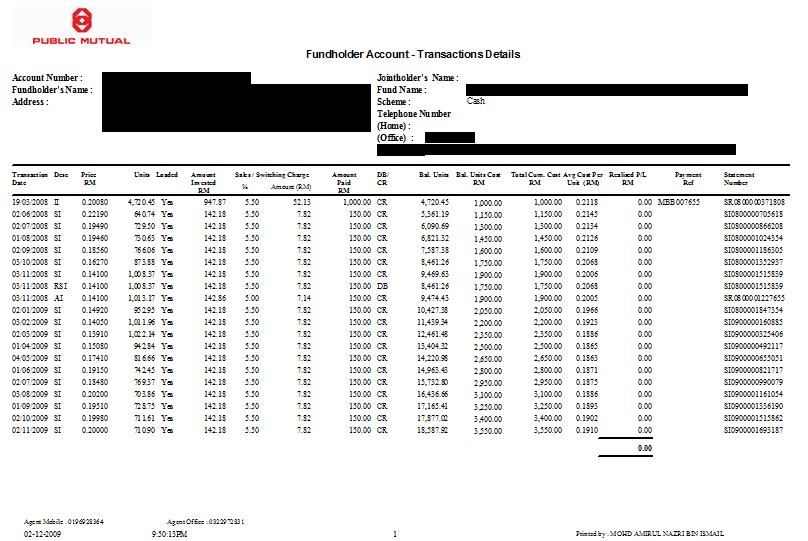

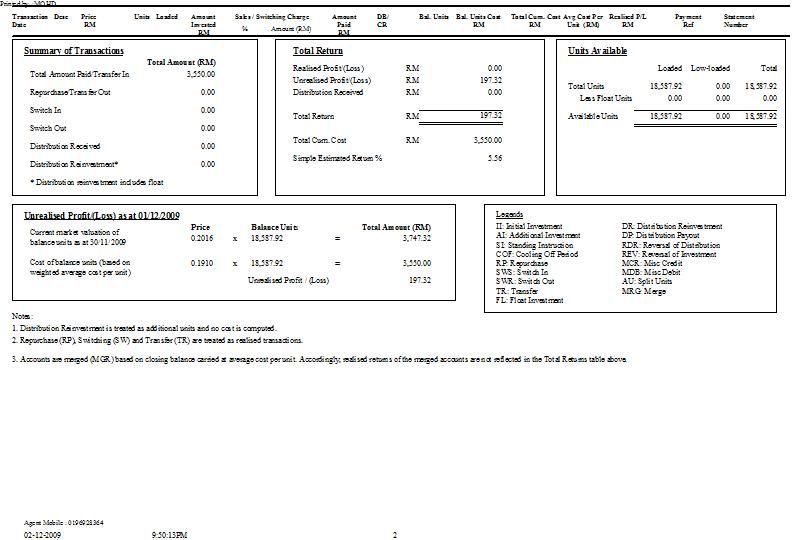

salah seorang client aku yg buat RCA di PCIF..initial investment 1000 pada bulan 3, 2008 dan monthly topup RM 150..

dlm report tue, valuation date pada 30/11/2009..Now, NAV dia is RM 3942 ++...

|

|

|

|

|

|

|

|

|

|

|

|

salah seorang client aku yg buat RCA di PCIF..initial investment 1000 pada bulan 3, 2008 dan monthly topup RM 150..

dlm report tue, valuation date pada 30/11/2009..Now, NAV dia is RM 3942 ++...

...

amirul_nazri Post at 10-1-2010 12:45

good info .... |

|

|

|

|

|

|

|

|

|

|

|

salam

nak tanya which from this fund yg boleh guna EPF?

PIEF

PIOF

PIttikal

ada yg lain tak? tq |

|

|

|

|

|

|

|

|

|

|

|

|

bro...kalau kita invsest duit kwsp dalam P Mutual ni berbaloike...pelaburan kita tu tak boleh di keluarkan sehingga berumur 55 tahun kan.. |

|

|

|

|

|

|

|

|

|

|

|

bro...kalau kita invsest duit kwsp dalam P Mutual ni berbaloike...pelaburan kita tu tak boleh di keluarkan sehingga berumur 55 tahun kan..

cucusaddam Post at 15-1-2010 22:53

pelaburan dlm kwsp blh dikeluarkan utk dilabur ke dlm PM sama mcm kita keluarkan duit utk beli rumah, byr pendidikan dll.

tp bila kita repurchase dari PM, duit tu akan masuk terus ke dlm akaun KWSP you.

regards |

|

|

|

|

|

|

|

|

|

|

|

|

PM br luanch fund baru,,any info?? |

|

|

|

|

|

|

|

|

|

|

|

854# lostnfaun

nah...

Guiding your Shariah-compliant

investments to high potential returns

through the Asia economic recovery - An Islamic equity fund that seeks to achieve capital growth over the medium- to long-term period by investing mainly in stocks of companies with market capitalisation of US$1 billion and above in domestic and regional markets that comply with Shariah requirements.

- Equity exposure: Generally range from 75% to 98% of its net asset value (NAV).

- Suitable for aggressive investors who wish to participate in Asia's economic recovery.

Enjoy special service charges

for investments into

Public Islamic Asia Leaders Equity Fund

(PIALEF) during offer period. Investment amount

per transaction | Special Service Charge | RM5,000 to RM9,999

per transaction | 5.25% of Initial Issue

Price per unit | RM10,000 and above

per transaction | 5.00% of Initial Issue

Price per unit |

Offer Period

19 January to 8 February 2010 (21 days) Initial Issue Price During Offer Period

RM0.2500 per unit * DDI Terms and & Conditions

|

| Public Islamic Asia Leaders Equity Fund | | FUND INFORMATION | | Category of Fund | | Equity Fund (Shariah) | | | Approved Fund Size | | 1.5 Billion Units | | | Launch Date | | 19 January 2010 | | | Investor's Risk Profile | | Aggressive | | | Fund Objective | | To achieve capital growth over the medium to long term period by investing mainly in stocks of companies with market capitalisation of US$1 billion and above in domestic and regional markets that complies with Shariah requirements. | | | | | | |

| | FEES & CHARGES | | | Service Charge | | Up to 5.5% of NAV per unit | | | Repurchase Charge | | NIL | | | | Annual Management Fee | | 1.6% per annum of the NAV | | | | Annual Trustee Fee | | 0.08% per annum of NAV, subject to a minimum fee of RM18,000 per annum. | | | | | UNIT TRANSACTION | | | Buying & Selling | | At NAV per unit (Forward Pricing). Upon the purchase of units of the fund by investors, a service charge of up to 5.5% is levied. The Manager does not impose a repurchase charge on the sale of units of the fund by investors. | | | | Minimum Initial Investment | | RM1,000 | | | | Minimum Additional Investment | | RM100 | | | more |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

851# azzahra83

| Fund | Types | Category | | Public Islamic Balanced Fund (PIBF) | Islamic | Balanced | | Public Islamic Income Fund (PI INCOME) | Islamic | Bond | | Public Islamic Dividend Fund (PIDF) | Islamic | Equity | | Public Islamic Select Enterprises Fund (PISEF) | Islamic | Equity | | Public Islamic Equity Fund (PIEF) | Islamic | Equity | | Public Islamic Optimal Growth Fund (PIOGF) | Islamic | Equity | | Public Islamic Sector Select Fund (PISSF) | Islamic | Equity | | Public Islamic Select Treasures Fund (PISTF) | Islamic | Equity | | Public Islamic Money Market Fund (PIMMF) | Islamic | MM | | Public Select Bond Fund (PSBF) | Conventional | Bond | | Public Index Fund (PIX) | Conventional | Equity | | Public Regular Savings Fund (PRSF) | Conventional | Equity | | Public Sector Select Fund (PSSF) | Conventional | Equity | | Public Money Market Fund (PMMF) | Conventional | MM |

|

|

|

|

|

|

|

|

|

|

|

|

855# kirawang

bro, any komen utk fund baru nie? |

|

|

|

|

|

|

|

|

|

|

|

lostnfaun

nah...

Offer Period

19 January to 8 February 2010 (21 days)Initial Issue Price ...

kirawang Post at 22-1-2010 20:44

Bro, bagi la apa2 latest update... |

|

|

|

|

|

|

|

|

|

|

|

laa..ada thread ni yee..mana u jumpa ni..ingat dah berkubur dah..

btw, saya nak nasihatkan for those yang buat investment dlm u trust regardless any co u have invested, better u all check return masing masing since market tgh tinggi.. |

|

|

|

|

|

|

|

|

|

|

|

Taun depan kalau betul ekonomi jatuh lagi ...

leh la beli unit trust ni |

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|