|

|

Reply Jesse_Mccartney

Phase 1 iaitu deravatives market start crack...

pada 10 May 2012 JP M ...

pengecatbintang Post at 3-6-2012 21:57

betulke currency war ni dah start? tp, utk mempercayai china dan japan ignore usd, mcm pelik jah..  |

|

|

|

|

|

|

|

|

|

|

|

Reply Jesse_Mccartney

Phase 1 iaitu deravatives market start crack...

pada 10 May 2012 JP Morgan umum rugi USD2 billion dr pelaburan deravative...

start tu lah pasaran saham dunia mula jatuh... angka Bank For International Settlements bgtau... total derivative market dunia adalah USD6XX trillion..

pengecatbintang Post at 3-6-2012 21:57

http://johngaltfla.com/wordpress/2012/06/03/647762000000000-reasons-to-worry-the-derivatives-time-bomb/

647,762,000,000,000 Reasons to Worry: The Derivatives Time Bomb

by John Galt

June 3, 2012 19:10 ET

The hits just keep coming and with $647 trillion reasons to worry, aka, the total notional derivatives now outstanding as of Q4 in 2011 per the Bank of International Settlements just released this afternoon and published officially on Monday (click here for the PDF of the full report). The really, really good news is that our Federal Reserve has this completely under control and the trillions of dollars in Credit Default Swaps (CDS) and European Interest Rate Swaps will as always settle without concern.

Right?

Of course the problem is that as one can see in the graph above, the amount of Gross Credit Exposure has returned to 2008 levels, something the world might want to pay attention to. Once the lessons of the mistakes of the past are ignored, the risk factor increases proportionally and with Europe teetering on the edge of a Lehman event, the increase in interest rate derivatives might well indicate a new risk that has not been accounted for:

A sudden collapse of the Euro currency below the 1.20 or even parity level.

Such an event would make Lehman look like a picnic but there is more bad news beyond that as it is not just interest rate derivatives that have increased past 2008 levels as the chart above demonstrates, but some idiots placed bets on the currency markets which means that a collapse of the Euro creates an irreversible game of dominoes and destruction:

bla bla bla

Got gold? (pertanyaan artikel ni) |

|

|

|

|

|

|

|

|

|

|

|

betulke currency war ni dah start? tp, utk mempercayai china dan japan ignore usd, mcm peli ...

AuReusium Post at 5-6-2012 00:06

cuba google... "China and Japan begin direct currency trading"...

Al Jazeera pon laporkannya....

cuba jugak google... "india buy iran oil using gold"

pertanyaan saya pd AuReusium...

dah convert cash & paper assets kpd physical Gold & Silver ? |

|

|

|

|

|

|

|

|

|

|

|

belum , pengceatbintang, jujurnya ni ai baru gigih geledah thread ekonomi ni.... lepa ...

AuReusium Post at 5-6-2012 00:30

jangan hirau apa yg berlaku... tak cukup menangis jer...

yg paling utama... pi beli emas fizikal... setakat ni yg termurah di Malaysia adalah...

Australian Nugget 1 Oz (United Oversea Bank di Jalan Raja Laut - sebelah HQ KWSP) & Kijang Emas 1 Oz (Maybank tertentu jer jual)

jgn banyak soal... take action.. pi beli terus.... at least... ada 10 keping...

regew la ni... antara RM5200 - 5300 PER Oz... 1 Oz = 31.105 gram...

ko belajar melalui bacaan pasal emas n silver dari posting2 forumer...

Kita lihat apa yg bakal berlaku ujung tahun ni...

aku rasa Aust Nugget & Kijang Emas 1 Oz tu sold out...

kalo camtu... beli jer barang kemas.... asalkan fizikal n ko simpan sendiri... |

|

|

|

|

|

|

|

|

|

|

|

belum , pengceatbintang, jujurnya ni ai baru gigih geledah thread ekonomi ni.... lepa ...

AuReusium Post at 5-6-2012 00:30

ini lebih teruk dari 1997/1998

bila Euro lingkup... 2 ke 4 minggu kmdian USD turut lingkup... (ujung tahun ni USD will die)

fiat money dunia yg lain akan turut lingkup...

matawang dunia yg baru akan diperkenalkan... iaitu partially back by gold & silver |

|

|

|

|

|

|

|

|

|

|

|

Post Last Edit by pengecatbintang at 5-6-2012 13:29

kita belajar sejarah skett...

1940s... selepas perang dunia ke 2...

ahli2 ekonomi dr negara2 besar dunia buat perjumpaan utk bentuk Global Monetary System...

dipersetujui... (perjanjian Bretton Wood - sila google)

1. USD backed by Gold (officially pd masa tu.. simpanan Gold US adalah terbesar di dunia iaitu 8,XXX tan...

2. Matawang Fiat yg lain pulak... peg to USD...

3. early 1970s... France demanded US to pay their debt using Physical Gold... but US refused..

4. ekoran No. 3... President Nixon closed their gold window... and stop link between USD dgn Gold... sejak itulah nilai USD floating sampai la ni...

5. ekoran no. 4, nilai USD mendadak turun... tetapi nilai silver n gold mendadak naik...

6. Rege gold n silver price peak pd 1980... pada masa ni... Paul Volcker (Federal Reserve Chairman yg baru dilantik) naikkan interest rate kpd 20%...

disamping tu, US wat perjanjian ngan family Saud... kalo nak jadi pemerintah Arab Saudi... kena jual petroleum guna USD....

Arab saudi adalah pengeluar petroleum yg terbesar dlm cartel OPEC... so lain2 negara ikut jejak langkah Arab Saudi...

7. ekoran 2 tindakan yg dibuat pd No. 6... USD naik balik

8. Sejak 1980 sampai sekarang... rege Physical Gold & Silver ditentukan oleh transaksi paper gold & silver... menggunakan harge paper... harga fizikal gold n silver dimanipulate...

tahun 2009... whistleblower dr London bgtau... ratio Gold paper : fizikal yg dijual adalah 100 : 1

Silver lak.... annual global production 700 juta ounce...

Tahun 2012... ada 3 kali silver price telah dimanipulate secara besar2an...

a. ujung April... 685 juta ounce paper silver dijual dlm masa 1 jam

b. baru2 ni... kalo tak silap ujung May or awal Jun.... 500 juta ounce paper silver dijual dlm masa 2 jam...

c. satu lagi date aku x ingat (he he), tp sblm a ler...

dari no. 1 hingga 8 ianya merupakan PRESENT WORLD ORDER

--

rest jap... |

|

|

|

|

|

|

|

|

|

|

|

NEW WORLD ORDER

memandangkan semua urusan kat dunia ni (kecuali kasih sayang) perlukan duit...

maka NEW Global Monetary System akan digunakan untuk kick start NEW WORLD ORDER (NWO)..

so, kalo nak sistem yg baru... kena lingkupkan yg lama...

camner...

deravative market yg diperkenalkan in 1980s akan trigger Global Financial Collapse pd tahun ni...

akibat Global Financial Collapse yg akan berlaku x lama lagi (tahun ni kot?!).. Perancang NWO mahukan semua manusia & negara dlm DUNIA ni... in MASSIVE DEBT...

selain itu, paper assets termasuk fiat money, 401k, IRA, syer, turut lingkup iaitu tiada nilai.. cuma nilai kertas tu jer

debt akan digunakan untuk CONTROL kita...

bila berlaku 4 phase tersebut, baru lah euro breakup... diikuti USDollar... matawang fiat yg lain turut Gone With The Wind

---

Ini lah fundamental yg saya pegang... so, saya tak timing harga untuk beli PHYSICAL GOLD & SILVER...

tp awas... saya ni dicop sebagai CONSPIRACY THEORIST (CT)...

ramai kat CI ni yg anti dgn CT...

pd yg anti tu... tak yah ler percaya cerita yg mengarut ni..

kui kui kui |

|

|

|

|

|

|

|

|

|

|

|

http://www.bloomberg.com/news/20 ... -price-drop-1-.html

Soros, Eton Park Raised Gold ETP Holdings Before Price DropBy Debarati Roy - May 17, 2012 2:11 AM GMT+0800

Billionaire investor George Soros increased his holdings in the SPDR Gold Trust in the first quarter while John Paulson maintained his stake, the fund’s largest, before bullion prices erased gains for the year.

Soros Fund Management more than tripled its investment in the largest exchange-traded fund backed by bullion to 319,550 shares, Securities and Exchange Commission filings reflecting holdings in the three-month period showed yesterday. Eric Mindich’s Eton Park Capital also bought shares, while Paulson & Co. kept its investment at 17.3 million shares. |

|

|

|

|

|

|

|

|

|

|

|

NEW WORLD ORDER

memandangkan semua urusan kat dunia ni (kecuali kasih sayang) perlukan duit...

...

pengecatbintang Post at 5-6-2012 13:44

matawang dunia yg baru akan diperkenalkan untuk menggantikan USD yg dijangka akan die by the end of 2012...

matawang baru ni partially back by gold & silver...

--

pikir bole pikir... tp jgn terlambat bertindak...

nnt menyesal |

|

|

|

|

|

|

|

|

|

|

|

yg paling utama... pi beli emas fizikal... setakat ni yg termurah di Malaysia adalah...

Australian Nugget 1 Oz (United Oversea Bank di Jalan Raja Laut - sebelah HQ KWSP) & Kijang Emas 1 Oz (Maybank tertentu jer jual)

Keh, sib baik 2 institusi ni ada jual benda Allah ni. Klu x pening gak nak import-eksport bagai.

Abis duit gaji ana tiap2 bulan shopping kt sini, mmg berbaloi-baloi... |

|

|

|

|

|

|

|

|

|

|

|

Post Last Edit by pengecatbintang at 6-6-2012 08:26

kita belajar sejarah skett...

ahli2 ekonomi dr negara2 besar dunia buat perjumpaan utk bentuk Global Monetary System...

dipersetujui... (perjanjian Bretton Wood - sila google)

4. ekoran No. 3... President Nixon closed their gold window... and stop link between USD dgn Gold... sejak itulah nilai USD floating sampai la ni...

pengecatbintang Post at 5-6-2012 13:25

http://www.marketoracle.co.uk/Article34999.html

Silver: A Tier 1 Asset for All

Commodities / Gold and Silver 2012 Jun 05, 2012 - 06:17 AM

By: Dr_Jeff_Lewis

In recent years, precious metals, most notably silver and gold, have played an unusual dual role as both monetary and non-monetary commodities. That may be in the process of changing for major financial institutions to favor holding metals as collateral as the Basel Committee ponders allowing banks to use gold as a Tier 1 capital asset.

Despite its well established and richly deserved safe haven status, gold is currently considered a Tier 3 asset. Ironically, this places the yellow metal lower on the asset totem pole than un-backed government bonds, which currently have low or even negative yields on an inflation-adjusted basis.

Furthermore, gold is generally misunderstood and ignored, while silver is largely viewed as a commodity among investors and central bankers. In fact, Fed Chairman Ben Bernanke, in response to the question of why central banks hold gold, simply answered "Tradition”.

Precious Metals Rule Exter’s Asset Class Pyramid

This perspective contrasts sharply with that of John Exter, whose classic asset class pyramid organizes assets with respect to their risk and issued amounts. In order from the widest point of the inverted pyramid to the narrowest, Exter places small businesses, real estate, gems, OTC stocks, commodities, municipal bonds, corporate bonds, listed stocks, government bonds, Treasury bills and paper money. Gold is placed squarely at the most narrow point of the inverted pyramid, just below paper money.

According to Exter’s model, when credit expands, money flows to the wide top of the pyramid as capital is placed in more speculative and less liquid investment vehicles. Nevertheless, when credit contracts and debts are difficult to repay, those assets near the broad end of the pyramid are sold and money flows to more secure assets situated near the pointed end where gold rules supreme.

Gold and Silver Hold Dual Roles

Like gold, silver holds a position in the center of Exter’s pyramid as a commodity, as well as at the narrow bottom of the pyramid as a hard currency to which safe haven funds flow in financially troubled times. In contrast to gold, silver is also an affordable monetary asset in the mind of the average individual. For the man on the street, it acts as Tier 1 capital and is valued as a savings asset with a price that can never go to zero.

Furthermore, silver is a good news metal since economic growth tends to increase industrial demand, but its price also benefits from bad news as it becomes the ultimate hard currency for the masses in case of a severe financial crisis.

Remonetizing Precious Metals

Many people concerned over the global trend toward the use of uncollateralized paper currency in commerce, have called for a return to a gold or silver standard in order to provide some hard currency backing for the ever growing supply of paper money being issued by governments.

Nevertheless, in order for precious metals like silver and gold to become "re-monetized", the price would need to rise exponentially relative to paper currency like the U.S. Dollar and the Euro to back all the money printed over the last 40 years since then-U.S. President Richard Nixon shocked the world by unilaterally removing the U.S. Dollar from the gold standard by ending its convertibility.

This traumatic move lead to the eventual demise of the post-WWII Bretton Woods fixed currency exchange rate system, of which the Dollar was the lynchpin, and ushered in the current era of floating exchange rates.

By Dr. Jeff Lewis |

|

|

|

|

|

|

|

|

|

|

|

betulke currency war ni dah start? tp, utk mempercayai china dan japan ignore usd, mcm peli ...

AuReusium Post at 5-6-2012 00:06

http://etfdailynews.com/2012/06/04/the-end-of-the-u-s-dollar-has-already-begun-uup-udn-gld-iau-slv/

June 4th, 2012

Starting today, two of the world’s superpowers will begin to abandon the dollar as the world’s reserve currency. That’s a big deal, because for the past 70+ years nearly all of the business conducted across borders, between countries,

corporations and individuals has involved the

United

States dollar as its hub. dollar as its hub.

That meant that if you were a shipping company in Japan buying steel from China, you conducted the trade in dollars. If you didn’t have dollars, you needed to buy them from someone else – but you needed them. Then once the trade was conducted, you could transfer your dollars back into yuan or yen.

But starting in the next month, China and Japan will conduct business in yuan and yen. The dollar will be out of the loop. That’s a huge development.

China and Japan, the third- and fifth-largest economies by GDP in the world, are now beginning to abandon dollar-based trade with each other.

The Wall Street Journal published a story yesterday with the title, “Japan, China Currency Deal Symbolic Step; Broader Benefits Remain Unclear”.

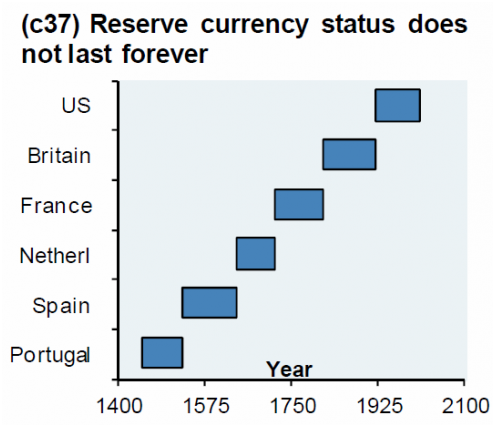

China and Japan are just two of the early countries heading for the exits. Already, China and Russia trade directly in their own currencies. As does India and Russia. In January of this year we heard rumors that India might buy oil from Iran with gold – bypassing not just the dollar but their own currencies as well. The main topic of a meeting between Brazil, Russia, India, China and South Africa (the BRICS nations) is an agreement to begin settling all contracts in their own currencies – cutting out the dollar further. According to an article published in the Economic Times last week, “India has proposed the idea of establishing a Brics bank.” We’ll look back at these early warning signs as obvious milestones in the dollar’s decline. I’m not saying the dollar will disintegrate with its reserve status. After all, the British pound sterling still exists. The French franc still existed for over a century after it lost its reserve status. As did the reserve currencies that previously held the status. But as the chart below reveals, the end of world reserve currency regimes happens about every hundred years or so.

It’s neither unusual nor does it mean the end of the world for the country that loses its status. Unlike many investors, I see the end of dollar hegemony not as a calamity to be feared and fought against, but as an inevitability to prepare for.

|

|

|

|

|

|

|

|

|

|

|

|

pengecatbintang..i bet u mesti ada & aktif dalam group fb Gold Lot Shop kan? u pakai nama apa dalam tu?  |

|

|

|

|

|

|

|

|

|

|

|

Reply 1578# samax

aku x aktif kat Lot Shop tu...

antara sebabnya... aku xder facebook....

so... x leh nak log in |

|

|

|

|

|

|

|

|

|

|

|

ada sesapa kat sini yg penah beli ngan IKGold tak?

http://ikgold.com/

mcmana ngan produknya.... |

|

|

|

|

|

|

|

|

|

|

|

Phase pertama iaitu derivative market problem...

phase kedua currency wars

phase ketiga trade wars

phase keempat kenaikan interest rate (dah beberapa tahun interest rate di US 0.25% jer)

paling akhir adalah lingkupnya US Dollar di mana sebelumnya didahului oleh lingkupnya Euro...

pengecatbintang Post at 20-5-2012 20:33

http://www.telegraph.co.uk/news/worldnews/europe/eu/9319548/As-the-eurozone-breaks-apart-Britain-must-go-its-separate-way.html

By Charles Moore8:11PM BST 08 Jun 2012

The best recent analysis comes from a great believer in the European project, the Henry Kissinger of the money markets, George Soros. This week, in Italy, he spoke to the Festival of Economics (there’s an oxymoron). He got widespread coverage for saying that only three months remained to save the euro, but it was his bigger picture of what is happening that matters more.

He had come to realise, he said, that the European Union itself was “like a bubble” in financial or stock markets.

Fear of break-up has started to dominate everyone’s plans. Today, says Mr Soros, the Bundesbank is terrified of whether it can recover its debts if break-up occurs.

|

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|