|

|

128# kirawang

Boss, aku tak dibenarkan balik kg ari tu oleh cardiologist AP...terpaksa beraya kat rumah sini je, apo bulih buat...

tam99 Post at 30-9-2009 17:08

kesian kat mung tam.,...sedap raya tahung ni negeri mat said,...patutlah aku tunggu mung punya call, tak dapat dapat...narodi pun tunggu gak.. |

|

|

|

|

|

|

|

|

|

|

|

Boss,

bila nak buat ari raya waktu training? Selasa (6/10) depang ka?

tam99 Post at 30-9-2009 17:52

kita tengok dulu tam..tanya jel kot dia nak buat makan makan ke..tp jel tak boleh masuk cari dah..kena block kat opis dia..

apapon, kita pakat makang kat rumah br Yakin this monday...mu nak pergi dok...

mu punya cucu tu... |

|

|

|

|

|

|

|

|

|

|

|

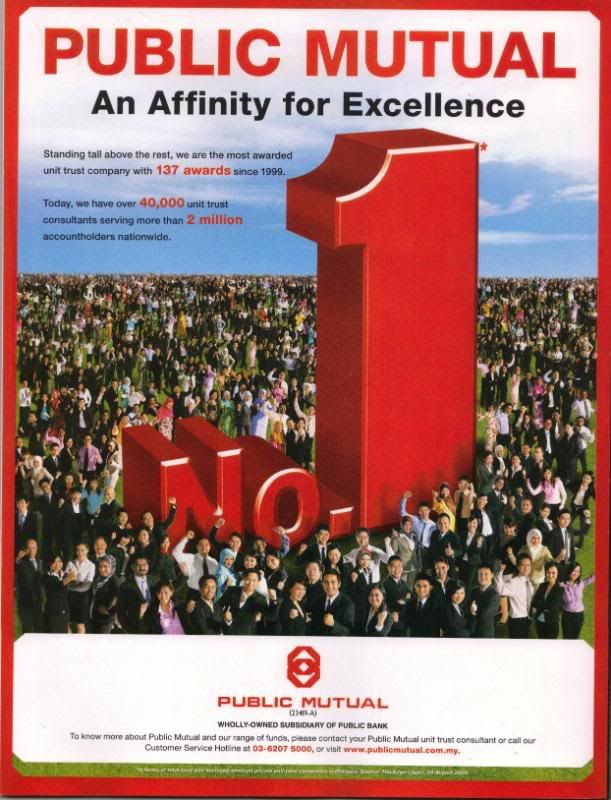

U all kena tahu statement ni..recession or not, investors ttp ada..

...........................

Recession impacts less on rich consumers

CRISIS or no crisis, the super rich still want their luxuries and beautiful things. The participants in a panel discussion titled The big spender economy: Glitter in gloom? agreed that global recession has less of an impact on the high-end consumer and collector markets than on most other businesses.

“It’s interesting to note that the greatest auction sale of all time took place in February this year,” said Christie’s International chief executive officer Edward Dolman. “We sold the art collection of Yves St Laurent in Paris for almost US$500mil. Extraordinary prices were paid for works of exquisite quality.”

David Michaels, creative director of BOKKS, a London-based company that has elevated gift giving into a luxury business, said: “Our customers are high net worth individuals, and they are still spending.”

However, the luxury goods industry still has challenges to overcome. Faberge Ltd CEO Mark Dunhill said many luxury brands had been overhyped and overextended, and the makers of such goods were still figuring out how to broaden their customer base without losing the allure and mystique that attracted the wealthy buyers.

“In the eyes of the discerning, high net worth customer, luxury has lost its lustre,” he added. This, he said, had sparked trends that typified the desire to go back to “true luxury”.

“First, there’s a flight to quality. The good news is the very wealthy of this world continue to spend but they are spending increasingly selectively.

“They have very clear and demanding criteria in making their purchases. They are buying fewer things but spending more on the things they buy,” said Dunhill.

Another major change in the world of big spenders is brought about by the economic growth of Asian countries such as China and India.

Said Dolman of Christie’s: “Our company’s strategy is squarely based on the assumption that the consumption and collection of works of art is being put together in Asia at a faster rate than anywhere else.

“We’ve come to conclusion that we are right now at the beginning, or possibly 10 years into the beginning, of the next really important movement, which is the sourcing and selling of great works of art from Europe and the United States to the Far East.”

He cited the example of a sale of Chinese works of art, sourced from the United States, in New York three weeks ago. The items were almost exclusively bought by mainland Chinese.

“We are now seeing the economic shift of power being reflected in collecting patterns. So it’s a very exciting time for us,” he added. A similar development, he pointed out, was the interest in establishing museums in the Gulf region. |

|

|

|

|

|

|

|

|

|

|

|

US stocks: Dow ends Sept as stroongest quarter in 11 years

NEW YORK: The stock market has ended a strong third quarter with trading that reflected investors' mixed emotions about the U.S. economy.

The major indexes closed slightly lower after zigzagging through the day.

Prices got a lift from the government's latest reading on the gross domestic product, then plunged on news of a surprise drop in Midwestern manufacturing.

The Dow Jones industrial average ended down 30 points as investors remained uneasy about economic data and shifted bets as the dollar strengthened.

The drop shaved only a modest amount from the Dow's 15 percent gain for the July-September period, its strongest quarter in 11 years.

The day's slide-and-bounce performance was a fitting one for the end of the quarter. When bad news hits the market, reminding investors of the economy's fragility, stocks slide.

But within a few days, or even the same day, they start to recover as investors seem to grab hold of the fact that no one expects the recovery, or stocks, to have an unbroken path upward.

"Any legitimate decline in the market is just seen as a buying opportunity," said David Waddell, senior investment strategist and CEO of Waddell & Assoc.

"That pattern has continued now ever since the rally began."

The slide that pulled the Dow down by more than 100 points in early trading began when the Chicago Purchasing Managers Index came in weaker than expected.

Investors worried that the drop meant the national Institute for Supply Management index due Thursday also would be weak.

Not all the news rattled investors.

The Commerce Department said the economy didn't sink as fast in the second quarter as it had estimated.

The gross domestic product, which is the broadest measure of the economy, slid at a pace of 0.7 percent, rather than 1 percent as it had projected.

Stocks pulled off their lows as the dollar weakened.

That makes U.S. goods cheaper to overseas customers and is seen as a boost for the U.S. economy.

Occasional squalls are to be expected after the quarter the stock market has seen.

The Dow's gain was its biggest since a surge of 17.1 percent in the final quarter of 1998, when the dot-com bubble was still inflating. |

|

|

|

|

|

|

|

|

|

|

|

masuk oct..

kita ada another 2 months..

check masing masing trip qualfifying masing2..

cash 1.5 dan epf = 1..

new poster kat jalan raya...

|

|

|

|

|

|

|

|

|

|

|

|

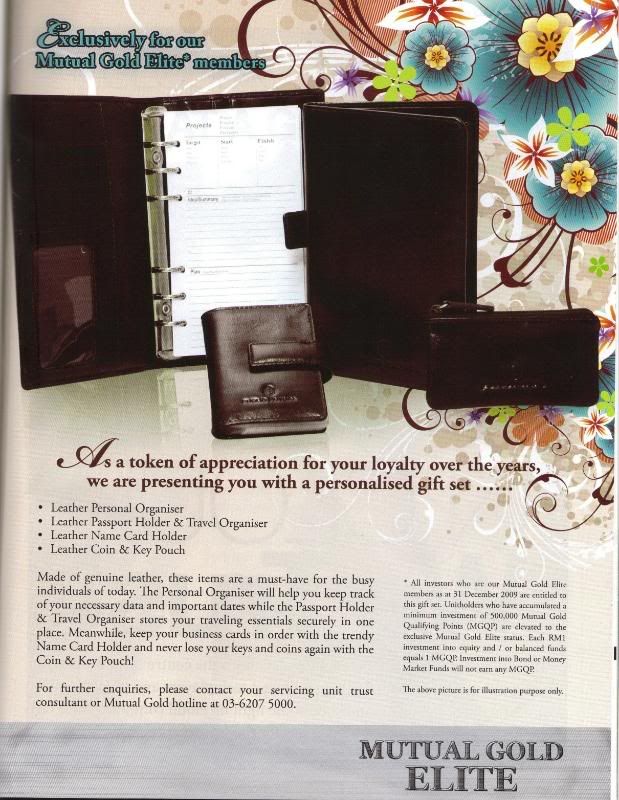

maintain 500k, dapat ini... |

|

|

|

|

|

|

|

|

|

|

|

U all semua dah dapatkan..

|

|

|

|

|

|

|

|

|

|

|

|

apa kau buek kat kepala tauke tu tam...

gambar kat bali tu, ramai yg tak nampak,,,mereka potong.,..tak muat kot..

|

|

|

|

|

|

|

|

|

|

|

|

berita baik untuk U all...

.....................................

Pasaran saham cecah 1,370 tahun depan

KUALA LUMPUR 5 Okt. - Indeks Komposit Kuala Lumpur FBM dijangka mencecah paras 1,370 mata pada tahun depan apabila pendapatan korporat dan nisbah pendapatan harga mula menunjukkan petanda pemulihan positif.

Semasa mengunjurkan prospek positif bagi bursa tempatan itu, Ketua Penyelidik TA Securities Holdings Bhd., Kaladher Govindan berkata, pasaran dijangka mendapat sokongan daripada pakej rangsangan yang dilaksanakan kerajaan pada 2009.

"Perdana Menteri mengambil langkah yang tepat setakat ini, saya percaya kita akan melihat kesannya tahun depan.

"Saya juga percaya terdapat banyak skim Inisiatif Kewangan Swasta (PFI) tidak lama lagi yang dijangka membawa kesan positif kepada pertumbuhan ekonomi dan pasaran saham tahun depan," kata Govindan selepas mesyuarat agung luar biasa TA Enterprise, di sini, hari ini.

Beliau juga menjangka lebih banyak skim PFI akan muncul dalam sektor minyak dan gas dan aktiviti hiliran dan ini, ditambah dengan projek pembangunan bernilai berbilion ringgit, yang dikatakan bakal dimajukan di Lembah Klang, dijangka memberi prospek yang baik bagi prestasi pasaran saham.

TA Securities, cabang pembrokeran saham TA Enterprise Bhd. itu juga percaya pasaran akan mengalami beberapa pembetulan kecil semasa tempoh menjelang kenaikan itu.

"Tentu sahaja, kami menjangkakan pembetulan kecil, jika kita lihat Indeks Dow Jones (Bursa Saham New York) sebagai petunjuk, dalam tempoh 12 tahun lalu, pasaran mengalami enam pembetulan utama, di mana empat daripadanya berlaku antara Ogos dan Oktober setiap tahun.

"Saya percaya, bagi tahun ini, bulan Oktober boleh menjadi tempoh pembetulan, dinilai daripada angka makro yang kurang memberangsangkan yang dikeluarkan beberapa minggu lepas.

"Namun, saya percaya ini hanya satu perkara yang berlaku sekali dan angka akan bertambah baik tahun depan dan seterusnya," kata Govindan. |

|

|

|

|

|

|

|

|

|

|

|

askm..

gua berminat aa nak jadi agen pm ni...how ek?tp maybe part time aa sbb keje ng gov...tgk geng2 korang ni dasyat2 aa, terbakar gua,heeheh..

anyway gua mmg invetor dlm pm melalui my bro in law..ble bgtau nak jd agen gak dia ckp xpayah, maybe sbb dia xnak keje gua tggu kot...so any sdvice?setakat ni gua dah kasi 2 org kwn gua kat abg gua 2...xbyk la diaorg invest dlm 20k ja... tp aku rasa rugi plak kalo aku yg agen mesti dpt sikit kan komisyen,heheh...so any komen...

gua tau group korang ni otai gak dlm pm@ut nie...so gua turut berbanggsa sbg saudara seagama n sebangsa...keep it up guys...

regards.. |

|

|

|

|

|

|

|

|

|

|

|

askm..

gua berminat aa nak jadi agen pm ni...how ek?tp maybe part time aa sbb keje ng gov...tgk geng2 korang ni dasyat2 aa, terbakar gua,heeheh..

anyway gua mmg invetor dlm pm melalui my bro in ...

isahashim Post at 7-10-2009 22:56

Kalau Tuan dah call Razali tu, tolong inform yer. |

|

|

|

|

|

|

|

|

|

|

|

Post Last Edit by tauke at 9-10-2009 15:51

Post Last Edit by tauke at 9-10-2009 15:50

FBM KLCI reaches new year high on US earnings optimism

KUALA LUMPUR: Shares on Bursa Malaysia tracked their peers and closed higher on Thursday, with the FBM KLCI reaching their highest levels of the year.

A late spurt of buying lifted the FBM KLCI by 11.5 points to 1,230.1 points. Advancing stocks beat declining ones by a 3-to-2 ratio on volume of 813 million shares.

Actively traded stocks include KNM, Hubline, Time, Green Packet, AirAsia and CIMB. Major gainers include CIMB, MISC BAT and Public Bank-foreign. Losers include Kulim, Genting and Proton.

Asian stock markets were higher as investors expected a strong opening on Wall Street and eyed earnings from major US companies. The Dow futures was up after Alcoa, a major index component and the first to kick-off the third quarter earnings season, announced it was profitable after three losing quarters.

Investors looking for further global economic recovery signs were also pleased with news that Australia's unemployment rate dropped from 5.8% to 5.7% in September — in addition to the 25bp interest rate rise announced this week.

Continued weakness in the US dollar sent commodity prices higher, although some saw profit-taking activities after recent gains. Gold rose to a new record high of US$1,049 (RM3,556.11) an ounce. The ringgit rose to a 13-month high of RM3.39 to the greenback.

Investors are welcoming the Australian interest rate hike and rising commodity prices as further evidence that the global economy is on the mend. However, pronounced sharp increases in commodity prices and falls in the US dollar will have repercussions on inflation, growth (which is still tepid) and the ability of the US to fund its deficits — and this will lead to other problems.

Going forward, investors will take their cues from the upcoming third quarter earnings season, which will help determine the direction of Wall Street — and global equity bourses. Investors will also await the reopening of the Chinese stock market on Friday after the National Day holidays |

|

|

|

|

|

|

|

|

|

|

|

U all semua dah dapatkan..

?t=1254711938 ?t=1254711938

kirawang Post at 5-10-2009 11:06

kw,

perghh..yr article boleh motivate other people bro...

bangga gak dengan remiser aku ni...

bila nak lepak lepak ni..

aku ada kat kl ni... |

|

|

|

|

|

|

|

|

|

|

|

[url=http://forum.cari.com.my/redirect.ph

p?goto=findpost&pid=34035433&ptid=431972]152#[/url] tauke

right time to tambah ke,.. |

|

|

|

|

|

|

|

|

|

|

|

aku tak penah dgr lagi ada agen UT kata WRONG time...

alwayssss RIGHT....

ekekekee.... |

|

|

|

|

|

|

|

|

|

|

|

aku tak penah dgr lagi ada agen UT kata WRONG time...

alwayssss RIGHT....

ekekekee....

chayuk Post at 9-10-2009 09:48

right time to tambah with the right STRATEGY i must say that.... |

|

|

|

|

|

|

|

|

|

|

|

|

razali 2 sape ek tauke... |

|

|

|

|

|

|

|

|

|

|

|

razali 2 sape ek tauke...

isahashim Post at 9-10-2009 14:20

Cikgu Razali. Dia kat Ipoh tu. |

|

|

|

|

|

|

|

|

|

|

|

158# tauke

cikgu razali ipoh tu ...

leh PM aku no phone dia tak tauke..... |

|

|

|

|

|

|

|

|

|

|

|

158# tauke

cikgu razali ipoh tu ...

leh PM aku no phone dia tak tauke.....

pojikun85 Post at 9-10-2009 15:54

dah................. |

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|