|

View: 1652|Reply: 0

|

China Stocks Lose US$3 Trillion, And Counting – Ready For A Huge Burst?

[Copy link]

|

|

|

China Stocks Lose US$3 Trillion, And Counting – Ready For A Huge Burst?

JUL072015

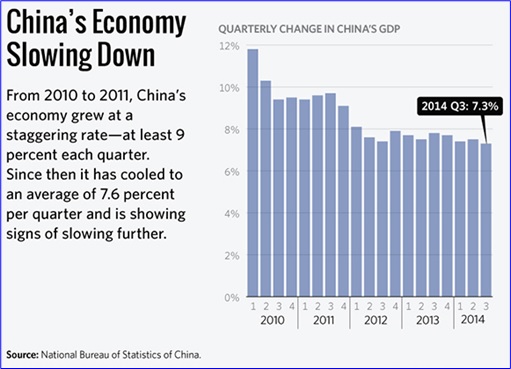

Is the party over for China? Nobody knows for sure. But it doesn’t seem to be doing as well as it used to be. It’s double-digit growth was long gone. The last time the world’s second-largest economy saw double-digit growth rates was in 2010 when it grew at a rate of 10.6%. Thereafter, it was 9.5% (2011), 7.8% (2012), 7.7% (2013) and 7.4% (2014).

There was brouhaha about China returning to its double-digit growth last year, but it didn’t happen. Despite single-digit growth for the last 3-years, the world didn’t end, did it? Nope, the globe is still spinning. China’s slowing economy doesn’t crash the global economy. But that’s because its property and stock markets are still holding on, but not for long.

The country’s job market is slowing down. It’s getting harder and harder to find jobs, even if the graduates received their foreign education. So much so that a mainland university, Kunming University, has launched a “talent shop” to sell its graduates to prospective employers online on sites such as Alibaba’s Taobao.

But the latest and biggest problem is the mainland’s stock market. China’s stock market has crashed 30% since its June 12 peak, ending an 8-month-long bull run. It got so bad that a whopping 700 companies have issued requests to suspend trading. The fact that the number represents 25% of firms listed speaks volumes about the severity of the problem.

The 702 firms, out of roughly 2,808 firms listed on the main Shanghai and Shenzhen bourses, said the trading halts were due to restructuring, planned share placements or the pending release of a “significant matter”. Of course, any veteran traders know those were merely excuses. They are halting trading to prevent further falls in their share prices, that’s all.

Since its June 12 peak, the two indices combined lost roughly US$3 trillion (£1.92 trillion; RM11.45 trillion), with the index now up just 36% for the year, after being up 122% less than a month ago. Here’s what raises billions of eyebrows – so far, Beijing fails to stop the bleeding, despite numerous medications.

IPO, or initial public offerings, have been suspended to avoid new listings diverting funds for the secondary market. The move came hours after 21 major Chinese brokerage firms pledged no less than 120 billion yuan (US$19.3 billion) to form a stock market rescue fund. The ruling Communist Party has urged investors to stay calm. Still, panic selling continues.

There’s little doubt that the bubble has burst, at least to the small-cap/tech stocks. The 120 billion yuan may look like a lot of money, but that’s a drop in the ocean considering the daily turnover of over 2 trillion yuan. Any Chinese analyst or trader can tell you that the 120 billion yuan won’t last for an hour in such bearish market.

After the closing bell today (Tuesday), Shanghai bourse loses another 47.72 points or 1.26%, but not before it lost about 190 points in the morning. Here’s the tricky part. Should Beijing continue to intervene in a bigger wave? If it does, it may just make things worse because it would create a perception of desperation, and in the process invites bigger panic selling.

With US$3 trillion lost in market capitalization, which is more than 10-times the size of Greece’s economy, the Chinese government has every reason to be concerned. Beijing has also lowered interest rates 4 times since last Nov, relaxed restrictions on buying stocks with borrowed money and even trumpeted patriotic reasons for the public to hold on to their shares.

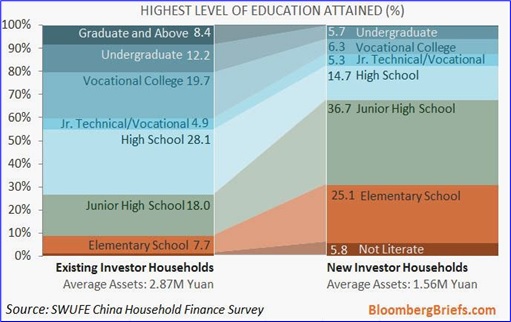

The root to the sudden crashes could be a simple one. According to Financial Times, more than 12 million new accounts were opened on the stock exchange in May alone. If that was not bad enough, consider the mind-boggling fact that two-thirds (67.6%) of households who opened accounts in the first quarter of 2015 didn’t even finish high school.

Obviously the bull run was due to relatively inexperienced retail investors. Does this sound like a casino or “pump and dump” scams? Absolutely. From the U.S. stock markets to the Malaysia stock exchange, such pattern happened before, and it’s happening now in China. So-called experts “stir-frying” stocks while the ignorant investors get screwed.

If you had experienced the Malaysia 1993 Super Bull Run, the same scenario happens in China. The stock market fever has even spread to China’s universities. So, instead of studying, 31% of college students are buying and selling stocks. And three quarters of them got their funding from their parents, who also involved in the stocks.

It doesn’t matter if China’s economy and exports are shrinking, because the Chinese people were making money in the stock market, until now. The rally in the stock market brought along a record margin debt of US$358 billion. During the peak of last year’s rally, the P/E ratio for Shenzhen Stock Exchange went as high as 146.57 times earnings.

Here’s the scariest part. The Chinese government has zero experience in handling a real full-blown bubble crash. This is the first time in 5,000 years of China civilization that the Chinese people has experienced a bull run for such a long time. Naturally, when it crashes, trillions of dollars would be wiped out. And we haven’t talk about its effect on property market (*grin*).

http://www.financetwitter.com/2015/07/china-stocks-losses-us3-trillion-and-counting-ready-for-a-huge-burst.html |

Rate

-

1

View Rating Log

-

|

|

|

|

|

|

|

|

|

| |

Category: Belia & Informasi

|